Late Fees

A trick credit card companies don’t want you to know

Please note: some of my posts may contain affiliate links. This means if you choose to make a purchase, I may receive a commission. However, I only recommend resources I know and love! See my full disclosure policy here.

Photo credit: @rupixen on Unsplash

It happens to the best of us, even those of us who keep a diligent eye on our budget.

Yes, even me - one of the nerdiest budgeters of them all.

We forget to make a payment on a credit card and are immediately hit with a late fee.

Just yesterday I realized that my payment was due on Monday. I saw the upcoming date last week but then life happened and all of a sudden it was Tuesday and there was a late fee on my account.

Ouch. There goes $25 I wasn’t planning to spend on a fee, right?

Not necessarily.

If you normally make on-time payments each month and haven’t been late recently, odds are good that you might be able to get your credit card company to waive the fee.

But you have to call and ask.

And if they’ve waived a fee for you recently, they may not do so again. They make it clear that they do this as a courtesy, so don’t rely on it.

But if it was an honest mistake, they can see your on-time payment history and might waive the fee for you this time.

For me, it took three minutes of my time to call and ask for the waiver. Three minutes well spent, if you ask me!

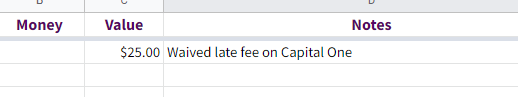

Then I immediately turned around and added that as value to my Abundance Tracker because now I am able to use that $25 somewhere else in my budget - somewhere that I chose!

And that is the ultimate goal - to make conscious decisions about where to spend your money, so that YOU are in control of your money, rather than your money (or in this case a credit card company) telling you where you have to put your hard earned dollars.

Ready to take control of your money?

Posts may contain affiliate links